Today, the Bureau of Economic Analysis released their quarterly figures for US Gross Domestic Product (GDP), raising important questions regarding the health of the current U.S. economy. During Quarter 2 2022, GDP fell by 0.2%, following a 0.4% decline in the first quarter. While traditionally economists view two quarters of decline in output as signs of a recession, this is a general rule of thumb and there are many factors involved moving forward.

This past quarter, housing construction (often referred to as residential fixed investment) declined by 14% at an annual rate. One of the most reactive sectors of the economy, this is likely due to the recent increase in interest rates, which made mortgages less accessible to certain buyers.

Additionally, business construction (including the construction of factories and warehouses) decreased 11.7% on an annual basis. This sector is similar to housing construction and is an indication of the recent hike in interest rates.

However, the increase in interest rates was an important move by the Fed to prevent more widespread issues of inflation in the economy. Inflation typically reflects that there is a surplus in demand compared to supply, and by increasing the cost of borrowing money, the Fed can help bring down demand and overall slow inflation – as reflected by the decreased demand in the housing and commercial real estate markets.

Inflation is a clear threat to the economy right now. With household income growing 1.6%, compared to prices growing by 1.7%, consumers are losing the value of their income. There are many causing to inflation this quarter. With increased oil prices as a result of the conflict in Ukraine, supply chain disruptions from China, etc., the Fed has little power to control these foreign disruptions, nor can it control the supply side of the domestic economy. The major threat right now for the Fed is playing a balancing role to mitigate risks presented by these issues. If the Fed slows demand too much to avoid inflation, companies will start laying off workers, leading to sharp increases in unemployment, leading to a recession regardless.

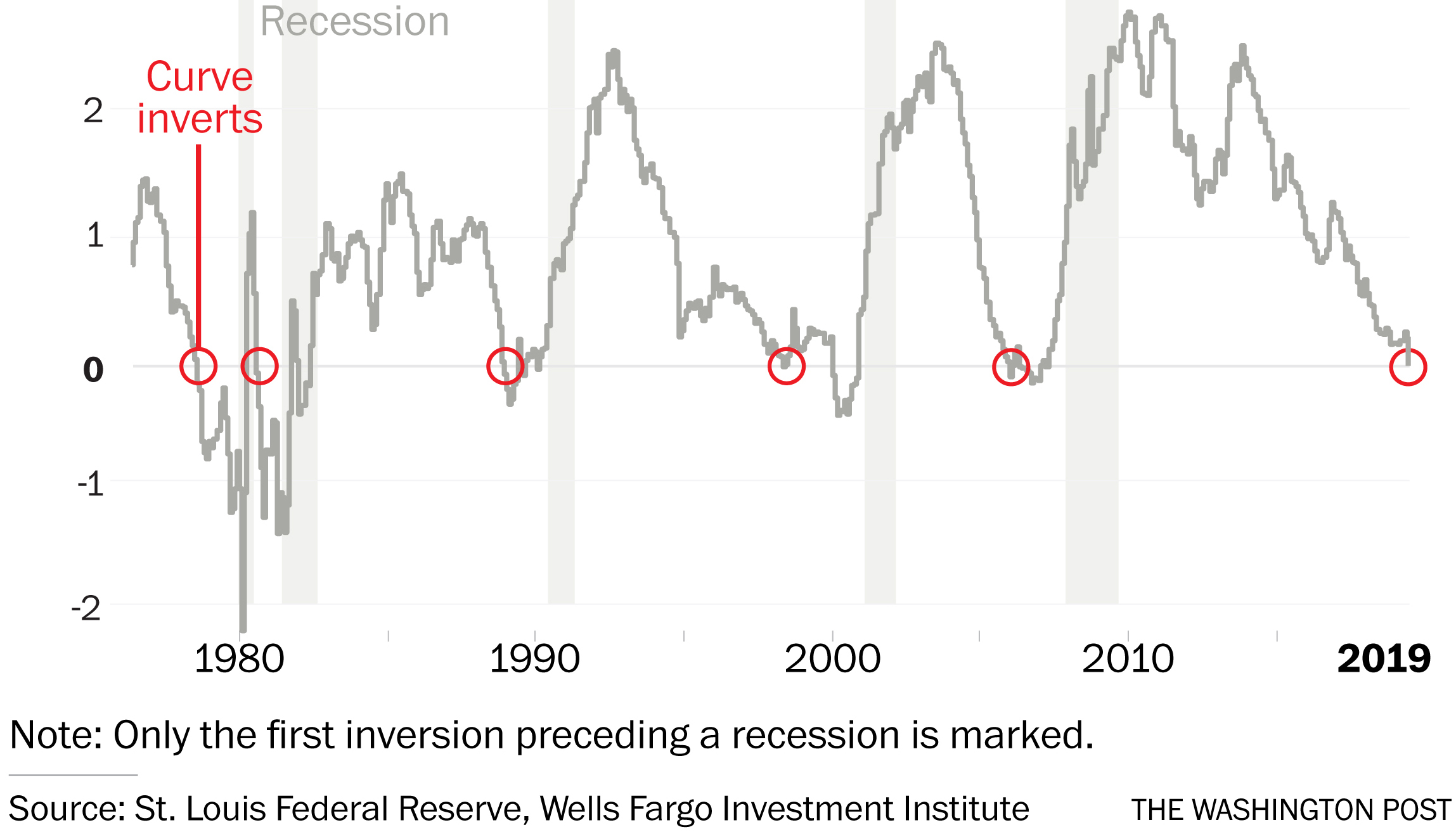

One final issue is the inversion of the yield-curve. Following the recent 75 basis point hike by the fed, the two year Treasury yield moved to be 32 basis points higher than the 10-year yield. Considered an indication of a future recession and a reflection on how the bond market feels about the long-term outlook for the U.S. economy. In the chart, every gray section is a recession – precedented by an inversion of the yield curve. However, it is not always accurate but it a good measure to consider.

While we will likely not know if we are currently in a recession for another few months, 2 quarters of decline is a good general rule of thumb. However, a recession needs to reach multiple sectors for a sustained amount of time – not just business investment and the housing market. Only time will tell the true state of the American economy.

Leave A Comment