As a result of the recent global pandemic forcing businesses to allow employees to work from home and using technology in a new way, less workers have returned to the office, preferring to work from their laptops instead. On the other hand, many companies prefer for their employees to be in the office despite being able to work from home. According to a newly released study by Microsoft, over half of all companies want their employees back in the office 5 days a week. The key issue for many is not if they should return to the office – but when.

According to an anonymous chief investment officer at a national real estate investment company who was surveyed by PWC and the Urban Institute, “Companies will try hybrid models, but everyone will eventually be back in the office. It is just too efficient to have everyone in one place.” However, the managing partner of a value-add investment firm who was also surveyed stated, “Hybrid work is here to stay. It just makes too much sense from a flexibility standpoint.”

Regardless of the future, right now office spaces are booming. Rent is rising and pundits are explaining how now is the time to be land lord as companies slowly return to the offices and require more flexibility in their office spaces. Yet, while the news may be excited at the growth across the country and the popularity of office spaces, it is unlikely that the boom is a big as we think.

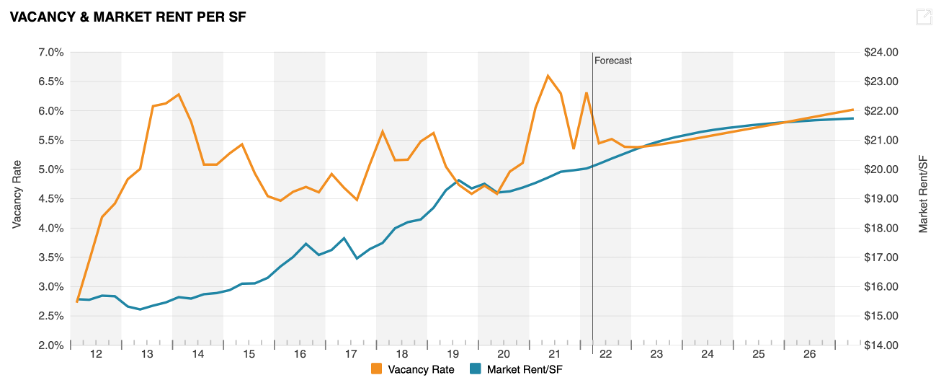

For example, the two graphs below detail historical and future trends for vacancy rates and market rent per SF. According to an analysis by Co-Star, “the office sector will likely take some time to stabilize as office occupiers begin to make long-term decisions,” preventing “landlords from pushing rent growth aggressively over the near term. While rent growth should remain positive in Gainesville, any significant further acceleration in growth rates is unlikely.”

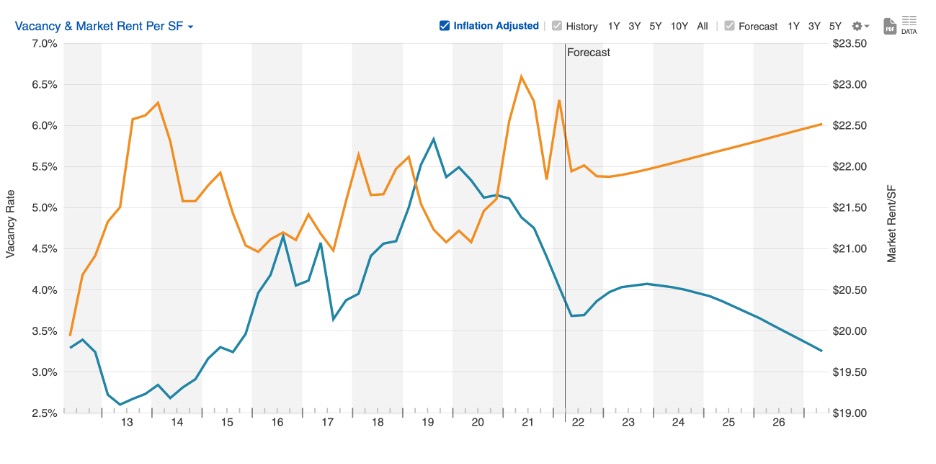

However, when inflation is taken into consideration, market rent has not necessarily increased this way. When adjusting for inflation, historical market rents have now decreased the past few quarters and the future trends are no longer positive and instead show a slowdown in value earned from market properties.

This is not to say that office spaces are struggling within the world of commercial real estate – in fact they are currently doing the opposite. However, the current trends can be misrepresented when inflation is not considered within the larger picture. Given it is unlikely inflation will improve within the next few months, it should be a metric to consider moving forward.

The truth is that no one has any idea how office spaces are going to develop moving forward. The world of commercial real estate is in uncharted territory and the impacts of the pandemic are going to be felt for years, if not permanently.

Above photo of current historic law office available for sale or lease. Contact Eric Ligman for more information.

Leave A Comment